UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

ý Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material under §240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) Title of each class of securities to which transaction applies: |

| (2) Aggregate number of securities to which transaction applies: |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) Proposed maximum aggregate value of transaction: |

| (5) Total fee paid: |

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) Amount Previously paid: |

| (2) Form, Schedule or Registration Statement No.: |

| (3) Filing Party: |

| (4) Date Filed: |

1716 Corporate Landing Parkway

Virginia Beach, Virginia 23454

Dear Fellow Stockholder:

You are cordially invited to attend Liberty Tax,Franchise Group, Inc.'s 20192020 Annual Meeting of Stockholders, which will be held via live webcast on Thursday, September 12, 2019Wednesday, June 3, 2020, at 11:3000 a.m., Eastern Time, atTime. In light of the public health concerns regarding the coronavirus (COVID-19) pandemic and to support the health and well-being of our corporate headquarters located at 1732 Corporate Landing Parkway, Virginia Beach, Virginia 23454. employees, directors and stockholders, we have made the decision to hold the Annual Meeting virtually this year. You will not be able to attend the Annual Meeting physically. Details regarding admissionaccess to the meeting and the business to be conducted are described in this Proxy Statement. We have also made available with this Proxy Statement a copy of our AnnualTransition Report to Stockholders,on Form 10-K/T for the transition period ended December 28, 2019, which includes our 2019 audited consolidated financial statements and provides information about our business.

The attached Proxy Statement, with the accompanying notice of the meeting, describes the matters expected to be acted upon at the meeting. We urge you to review these materials carefully and to take part in the affairs of our Company by voting on the matters described in the accompanying Proxy Statement. We hope that you will be able to attend the meeting.meeting via the webcast. Our directors and management team will be available to answer questions. Afterwards, therequestions, and you will be ahave an opportunity to vote onduring the matters set forth in the accompanying Proxy Statement.meeting.

The Company’s Board of Directors welcomes and appreciates the interest of all our stockholders in Liberty Tax,Franchise Group, Inc.’s affairs and encourages those entitled to vote at the Annual Meeting to take the time to do so. We hope you will attend the Annual Meeting via the webcast, but whether or notif you expectare unable to be personally present,do so, please vote your shares by either: (1) signing, dating and promptly returning the enclosed proxy card in the accompanying postage-paid envelope. envelope, (2) online at www.proxypush.com/frg until 11:59 p.m. (CT) on June 2, 2020, or (3) you may call 1-866-883-3382 via a touch-tone telephone to vote your proxy until 11:59 p.m. (CT) on June 2, 2020. We look forward to your attendance at the meeting and the opportunity to review our developments over the past months and to share with you our plans for the future.

On behalf of the entire Board of Directors, I'd like to thank you for your commitment and support.

| Sincerely, | ||

| ||

Chairman of the Board of Directors | ||

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELDSEPTEMBER 12, 2019JUNE 3, 2020

TO BE HELD

The Annual Meeting of Stockholders of Liberty Tax,Franchise Group, Inc. (the "Company") will be held at the Company's corporate headquarters located at 1732 Corporate Landing Parkway, Virginia Beach, Virginia 23454,via live webcast on Thursday, September 12, 2019Wednesday, June 3, 2020, at 11:3000 a.m., Eastern Time (the "2019"2020 Annual Meeting").

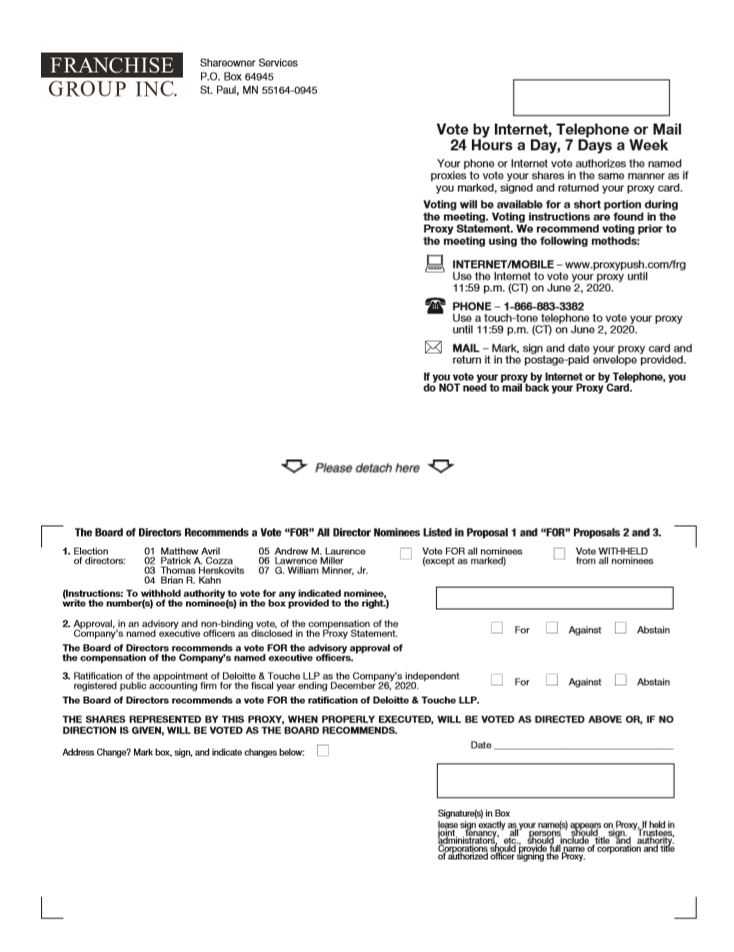

The 20192020 Annual Meeting will be held for the following purposes:

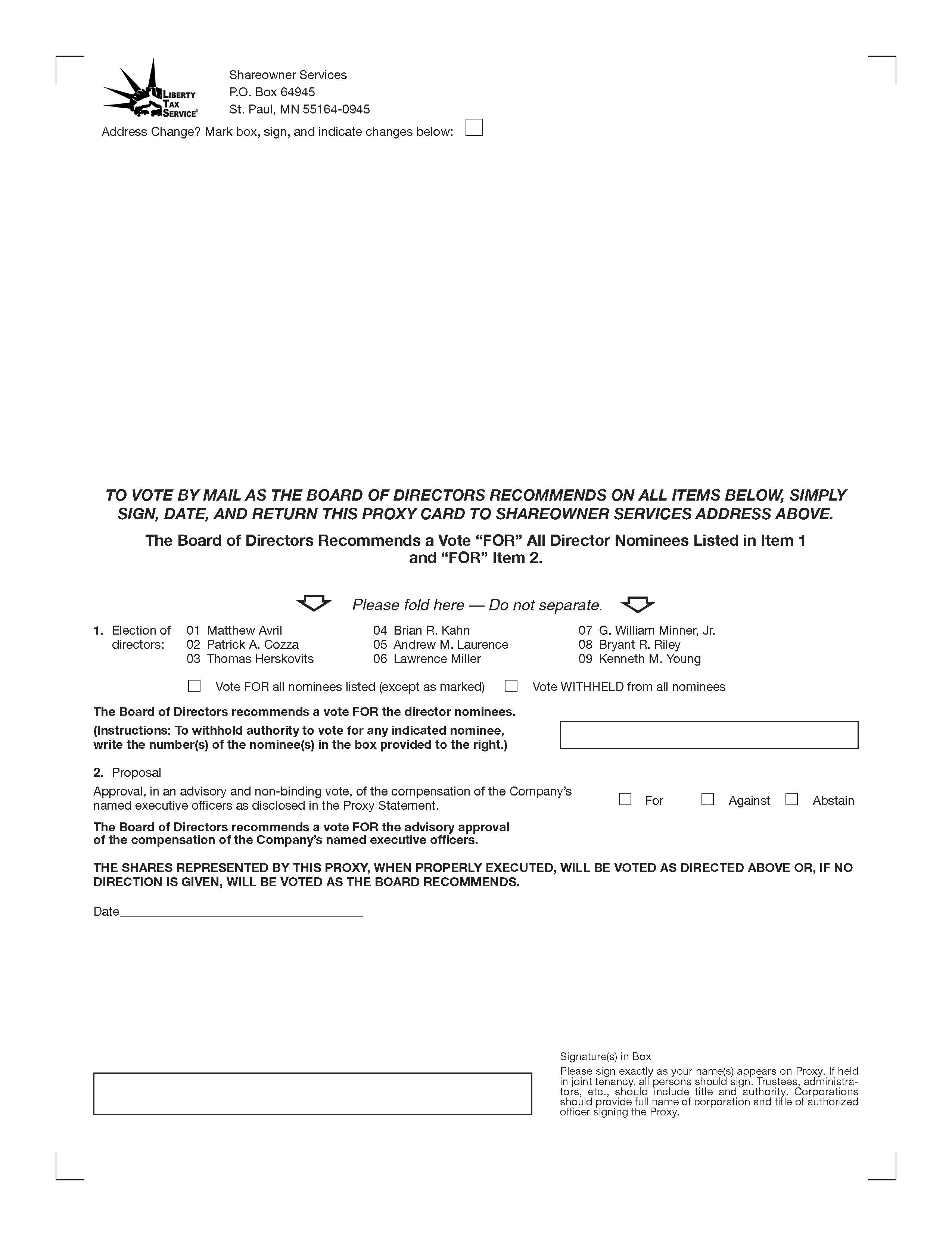

| 1. | Election of |

| 2. | Approval, in an advisory and non-binding vote, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement; |

| 3. | Ratification of the appointment of Deloitte & Touche LLP ("Deloitte") as the Company's independent registered public accounting firm for the fiscal year ending December 26, 2020 ("Fiscal 2020"); and |

| 4. | Transaction of any other business that properly comes before the meeting and any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this notice. The Board of Directors has fixed the close of business on July 26, 2019April 10, 2020 as the record date for determining stockholders of the Company entitled to receive notice of and vote at the meeting.

Stockholders of record of the Company's common stock, par value $0.01 per share ("Common Stock"), as of the close of business on July 26, 2019April 10, 2020 are entitled to receive notice of, and to vote at, the 2019 Annual Meeting. In addition, holders of the Company’s Voting Non-Economic Preferred Stock, par value $0.01 per share (“Preferred Stock”), are also entitled to receive notice of, and to vote at, the 20192020 Annual Meeting. Included in these materials are the Proxy Statement and the Company's 2019 AnnualTransition Report to Stockholders ("2019 Annual Report"on Form 10-K/T (the “2019 Transition Report”), as described in this Proxy Statement, which includes the Company's audited consolidated financial statements for the fiscal yeartransition period ended April 30,December 28, 2019 ("Fiscal 2019"(the "Transition Period"). The notice and proxy card are filed as part of the Proxy Statement. These materials are being sent to stockholders on or about August 12, 2019April 27, 2020 and are also available online at the Company's website at www.libertytax.comwww.franchisegrp.com and at the Securities and Exchange Commission ("SEC") website at www.sec.gov.

| By Order of the Board of Directors, | ||

| ||

Virginia Beach, Virginia

PROXY STATEMENT

TABLE OF CONTENTS

QUESTIONS AND ANSWERS ABOUT THE 20192020 ANNUAL MEETING AND VOTING

PROXY STATEMENT

This proxy statement ("Proxy Statement") is furnished in connection with the solicitation of proxies by the Board of Directors (the "Board") of Liberty Tax,Franchise Group, Inc., a Delaware corporation (the "Company") in connection withfor the Annual Meeting of Stockholders scheduled for September 12, 2019,which will be held via live webcast on June 3, 2020, at 11:3000 a.m., Eastern Time at the Company's corporate headquarters located at 1732 Corporate Landing Parkway, Virginia Beach, Virginia 23454 (the "2019"2020 Annual Meeting"). References to the 20192020 Annual Meeting and this Proxy Statement include any adjournment or postponement of the 20192020 Annual Meeting. The proxy materials were first mailed to stockholders on or about August 12, 2019.April 27, 2020.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on September 12, 2019June 3, 2020

The notice of the 20192020 Annual Meeting, this Proxy Statement and the Transition Report on Form 10-K/T for the transition period ended December 28, 2019 Annual Report("2019 Transition Report") are available online at the Company's website at www.libertytax.com.www.franchisegrp.com.

RECENT TRANSACTIONSDEVELOPMENTS

Fiscal Year-End Change

On July 10,October 1, 2019, based upon the Company and certain direct or indirect wholly-owned subsidiariesrecommendation of the Company entered into and completed certain transactions contemplated by an agreement of merger and business combination agreement (the “business combination agreement”) with affiliates of Vintage Capital Management, LLC (“Vintage”), providing for a series of transactions, includingAudit Committee, the acquisition by the Company of all of the outstanding equity interests in Buddy’s Newco, LLC (“Buddy’s), which operates substantially all of the Buddy’s Home Furnishings business (the “Merger”). A special committee of independent directors of theCompany's Board of Directors (the “Special Committee”) andapproved a change in the boardCompany’s fiscal year-end from April 30 to the Saturday closest to December 31 of managers of Buddy’s unanimously approved the Merger and the other transactions contemplated by the business combination agreement.each year, effective immediately. As a result of the Merger, each common unit of Buddy’s outstanding immediately prior to the Merger (other than common units held by Buddy’s,this change, the Company or their respective subsidiaries) was exchanged for 0.091863 shares of Voting Non-Economic Preferred Stock, par value $0.01 per share (the “Preferred Stock”) and 0.459315 common units of Franchise Group New Holdco, LLC, a wholly-owned direct subsidiary offiled the Company (“New Holdco”, and such common units, the “New Holdco common units”), each of2019 Transition Report which are, together with one-fifth of a share of Preferred Stock, redeemable on exchange for shares of common stock, par value $0.01 per share (“Common Stock”), pursuant to the certificate of designationincludes our audited consolidated financial statements for the Preferred Stockperiod from May 1, 2019 to December 28, 2019 and the limited liability company agreement of New Holdco after an initial six-month lockup period.

VOTING INSTRUCTIONS AND INFORMATION

Who may vote at the 20192020 Annual Meeting?

Each holder of the 16,197,49535,148,659 shares of the Company's Common Stock issued and outstanding at the close of business on July 26, 2019April 10, 2020 ("Record Date") will be entitled to receive a notice of the 20192020 Annual Meeting, and to attend and vote at the 20192020 Annual Meeting. These persons are considered "holders of record," and will be entitled to cast one vote per share owned for each proposal to be considered at the 20192020 Annual Meeting. Additionally, holders of the 1,616,667 shares of Preferred Stock issued in connection with the Merger will also be entitled to receive a notice of the 2019 Annual Meeting, and to attend and vote at the 2019 Annual Meeting. Each share of Preferred Stock has the equivalent voting power of five shares of Common Stock.

What proposals will be voted on at the 20192020 Annual Meeting?

Stockholders will vote on twothree proposals at the 20192020 Annual Meeting:

| 1. | Election of |

| 2. | Approval, in an advisory and non-binding vote, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement (Proposal 2); |

| 3. | Ratification of the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for the fiscal year ending December 26, 2020 ("Fiscal 2020") (Proposal 3); and |

| 4. | Transaction of any other business that properly comes before the meeting and any adjournment or postponement thereof. |

We are not aware of any matters to be presented at the 20192020 Annual Meeting other than those described in this Proxy Statement. If any matters not described in the Proxy Statement are properly presented at the 20192020 Annual Meeting, the proxies will use their own judgment to determine how to vote your shares. If the 20192020 Annual Meeting is adjourned, the proxies may vote your shares at the adjournment or postponement as well.

How does the Board of Directors recommend that I vote on these proposals?

The Board of Directors recommends that you vote your shares:

| 1. | "FOR" each of the Board's nominees for director (Proposal 1); |

| 2. | "FOR" the approval, in an advisory and non-binding vote, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement (Proposal 2); and |

| 3. | "FOR" the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for Fiscal 2020 (Proposal 3). |

Who will bear the cost of this proxy solicitation?

The Company will bear the entire cost of this proxy solicitation, including the preparation, assembly, printing and mailing of this Proxy Statement, the proxy card, 2019 AnnualTransition Report, and any additional solicitation materials sent by the Company to stockholders. The Company may reimburse brokerage firms and other persons representing beneficial owners of Common Stock and Preferred Stock for their expenses in forwarding the proxy materials to those beneficial owners. In addition, proxies may be solicited by directors, officers and regular employees of the Company, who will not receive any additional compensation for solicitation, by mail, email, facsimile, telephone or personal contact.

What is included in the proxy materials?

The proxy materials include:

This Proxy Statement for the 20192020 Annual Meeting, including a proxy card; and

Our 2019 Annual Report, which includes our audited consolidated financial statements for the fiscal year ended April 30, 2019 ("Fiscal 2019").Transition Report.

If I am a stockholder of record, how do I vote?

You may vote by the following methods:

By Mail. To vote by mail, by signing, datingyou will need to sign, date and returningreturn the accompanying proxy card that was sent to you with the proxy materials ormaterials.

By Phone. To vote by phone use a touch-tone telephone and dial 1-866-883-3382. You may only vote your proxy by phone until 11:59 p.m. (CT) on June 2, 2020.

By Internet. To vote by internet you may alsovisit www.proxypush.com/frg. You may only vote in personyour proxy by written ballot at the 2019 Annual Meeting.Internet until 11:59 p.m. (CT) on June 2, 2020.

How may I obtain directions toattend the 20192020 Annual Meeting?

Click on “I have a control number” and enter the 2019EQ control number.

Enter Meeting Code: FRANCHISEGROUP2020 (case sensitive).

We recommend accessing the Annual Meeting webcast using an up-to-date internet browser such as Chrome, Firefox, Safari, or Edge.

To submit questions in writing during the virtual Annual Meeting, you will need the 11-digit control number located in the upper right corner of your proxy card or notice. If you do not have a control number, please sign in by selecting "General Access," where you can attend as a guest, but you will not be able to ask questions or vote during the meeting.

If you are a stockholder whose shares are held in "street name" (i.e., in the name of a broker, bank or other similar organization), you must contact the broker, bank or other nominee that holds your shares to request an access code and meeting code and, if you would like to vote during the virtual Annual Meeting, a legal proxy giving you the right to vote your shares. To access the Annual Meeting, visit the link provided above, have your access code and meeting code available, and follow the instructions. You may only vote during the Annual Meeting by emailing a copy of your legal proxy to EQSS-ProxyTabulation@equiniti.com.

How do I vote before the 2020 Annual Meeting?

You may vote either by mail?mail, phone or you may vote online.

To vote on the proposals on the agenda by mail, simply complete the proxy card, sign and date it, and return it in the postage-paid envelope provided. If you are a stockholder whose shares are held in "street name" (i.e., in the name of a broker, bank or other similar organization), you may obtain a proxy, executed in your favor, from the record holder. You may sign the proxy card and return it to the Company or to Equiniti Group plc at the address indicated on the proxy card, or you may direct the record holder of your shares to vote your proxy in the manner you specify. Further, if your shares are held in street name, you must communicate your instructions respecting the voting of your shares to the record holder, or your broker will be prohibited from voting your shares. Voting by mail will not affect your right to vote in personduring the meeting if you decide to attend the 20192020 Annual Meeting; however, ifMeeting.

Voting by phone.

To vote on the proposals on the agenda by phone, please dial 1-866-883-3382 and follow the instructions provided by the operator. Please note that you wish to revokemay only vote your proxy by phone until 11:59 p.m. (CT) on June 2, 2020.

Voting by internet.

To vote on the proposals on the agenda by internet, please visit www.proxypush.com/frg. Please note that you may only vote your proxy online until 11:59 p.m. (CT) on June 2, 2020.

How do I vote during the 2020 Annual Meeting?

To vote during the Annual Meeting you must first notifyvote by phone or internet. The meeting website referenced above will direct you to the Corporate Secretary of your intentvoting link to vote online or provide instructions on how to vote on the phone. You will need a control number in person, and must actuallyorder to vote your shares in person atduring the 2019 Annual Meeting. You may vote during the Annual Meeting until the operator indicates that voting has been cut off.

What does it mean if I receive more than one set of proxy materials for the 20192020 Annual Meeting?

It means your shares are held in more than one account. You should vote all of your shares, using the separate proxy card provided with each set of proxy materials.

What is householding?

As permitted by the SEC, only one set of the proxy materials is being delivered to stockholders residing at the same address, unless the stockholders have notified the Company of their desire to receive multiple copies of proxy materials. This is known as householding.

The Company will promptly deliver, upon request, a separate copy of the Proxy Statement or the 2019 AnnualTransition Report to any stockholder residing at an address to which only one copy was mailed. Requests for additional copies for the current year or future years should be directed to the Corporate SecretaryCompany's Assistant General Counsel in writing at 1716 Corporate Landing Parkway, Virginia Beach, Virginia 23454, Attention: Corporate Secretary,Assistant General Counsel, or by email at kathleen.curry@libtax.com.tiffany.mcwaters@libtax.com.

How may I view the voting results?

The results of voting at the 20192020 Annual Meeting will be filed with the SEC within four business days after the 20192020 Annual Meeting and will be available on the SEC's website (www.sec.gov) or on our website (www.libertytax.com)(www.franchisegrp.com). If the final results are not available at that time, we will provide preliminary voting results in a Current Report on Form 8-K and will provide the final voting results in an amendment to the Current Report on Form 8-K as soon as they are available.

How may I revoke my proxy?

You may change or revoke your proxy at any time before it is voted at the 20192020 Annual Meeting. You can send a written notice of revocation of your proxy to the Corporate SecretaryAssistant General Counsel so that it is received before the taking of the vote at the 20192020 Annual Meeting. You can also attend the 2019 Annual Meeting and vote in person. Your attendance at the 2019 Annual Meeting will not in and of itself revoke your proxy. In order to revoke your proxy, you must also notify the Corporate SecretaryAssistant General Counsel of your intent to vote in person,another acceptable form, e.g., either by mail, by phone or by voting online, and then vote your shares atbefore or during the 2019 Annual Meeting.meeting. If you require assistance in changing or revoking your proxy, please contact the Corporate SecretaryAssistant General Counsel at 1716 Corporate Landing Parkway, Virginia Beach, Virginia 23454, Attention: Corporate SecretaryAssistant General Counsel or by email at kathleen.curry@libtax.com.tiffany.mcwaters@libtax.com.

What constitutes a quorum?

Holders of a majority of the voting power represented by the issued and outstanding shares of capital stock of the Company entitled to vote (taking into account the Preferred Stock) who are present in person or represented by proxy, will constitute a quorum at the 20192020 Annual Meeting. A quorum is required to transact business at the 20192020 Annual Meeting. A representative of Equiniti Group plc has been appointed by the Company's Board of Directors to act as the inspector of elections. The inspector of elections will tabulate the votes cast by proxy or in person at the 20192020 Annual Meeting and will determine whether or not a quorum is present. If a quorum is not present, the 20192020 Annual Meeting may be adjourned in order to solicit additional proxies.

How are votes counted?

Each holder of Common Stock will be entitled to one vote for each share of Common Stock held by such stockholder. Additionally, each share of Preferred Stock has the equivalent voting power of five shares of Common Stock. The holders of Common Stock and Preferred Stock will vote together as a single class on all matters. Except for the election of directors and except as otherwise required by law, the Second Amended and Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”) and the Second Amended and Restated Bylaws (the “Bylaws”), the affirmative vote of a majority of the voting power of the shares of capital stock present or represented by proxy at the meeting and entitled to vote on the subject matter shall be the act of the stockholders. A plurality of the voting power of the shares of capital stock present in person or represented by proxy at the meeting and entitled to vote with respect to the election of directors shall elect directors.

Election of Directors (Proposal 1)

To be elected as a Director, a nominee must receive a plurality of the voting power of the shares of capital stock present in person or represented by proxy and entitled to vote and, therefore, "withhold votes" will not impact the outcome of the elections.

Advisory and Non-Binding Vote to Approve the Compensation of the Company’s Named Executive Officers (Proposal 2)

Approval, in an advisory and non-binding vote, of the compensation of the Company’s named executive officers requires the affirmative vote of a majority of the voting power of the shares of capital stock present or represented by proxy and entitled to vote at a meeting at which a quorum is present. Under Delaware law, abstentions are counted as shares present and entitled to vote at the meeting. Therefore, abstentions will have the same effect as a vote "against" the approval, in an advisory and non-binding vote, of the compensation of the Company’s named executive officers.

Ratification of Independent Registered Public Accounting Firm (Proposal 3)

Ratification of the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for Fiscal 2020 requires the affirmative vote of a majority of the voting power of the shares present or represented by proxy and entitled to vote at a meeting at which a quorum is present. Under Delaware law, abstentions are counted as shares present and entitled to vote at the meeting. Therefore, abstentions will have the same effect as a vote "against" the ratification of the Company's independent registered public accounting firm.

Shares represented by proxy will be voted as directed on the proxy form and, if no direction is given, will be voted as follows:

| 1. | "FOR" the election of each of the director nominees; |

| 2. | "FOR" the approval, in an advisory and non-binding vote, of the compensation of the Company’s named executive officers as disclosed in the Proxy Statement; |

| 3. | "FOR" the ratification of the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for Fiscal 2020; and |

| In the best judgment of the persons named in the proxies, with respect to any other matters that may properly come before the meeting. |

What are broker non-votes, and how are they counted?

Brokers, banks or other similar organizations holding shares in street name for customers who are beneficial owners of such shares are prohibited from voting customers' shares on non-routine matters in the absence of specific instructions from those customers. This is commonly referred to as a "broker non-vote." With respect to the proposals in question, broker non-votes will be counted for quorum purposes but will not be counted as "votes cast" either for or against such proposals.

The election of directors and the advisory approval of the compensation of the Company's named executive officers are considered non-routine matters and, therefore, if you hold your shares through a bank, broker or other similar organization, the organization may not vote your shares on these matters absent specific instructions from you. As such, there may be broker non-votes with respect to these matters. Because broker non-votes with respect to these matters will not be counted as "votes cast," if your shares are held in street name, it is critical that you vote or provide specific instructions to your broker, bank or similar organization if you want your vote to count.

If you received more than one proxy card, you may hold shares in more than one account. To ensure that all of your shares are voted, you must signvote each proxy card by one of the approved methods: either by signing and return each proxy card.card by mail, voting each proxy card by phone or voting each proxy card online as described above. You are also always invited tomay attend the 2019 Annual Meeting and vote your shares in person.during the meeting.

Is my vote confidential?

Yes, it is our policy that documents identifying your vote are confidential. The vote of any stockholder will not be disclosed to any third party before the final vote count at the 20192020 Annual Meeting except:

To meet any legal requirements;

To assert claims for or defend claims against the Company;

To allow authorized individuals to count and certify the results of the stockholder vote;

To facilitate a successful proxy solicitation; or

To respond to stockholders who have written comments on proxy cards.

What is the Company's internet address?

The Company's internet address is www.libertytax.com.www.franchisegrp.com. The Company's filings with the SEC are available free of charge via the "About Liberty""Financial Information" link at this website (click on the "Investor Relations""SEC Filings" heading) and may also be found at the SEC's website at www.sec.gov.

PROPOSAL 1 - ELECTION OF DIRECTORS

Our Certificate of Incorporation and Bylaws provide that except as may be provided in a resolution or resolutions of the Board of Directors providing for any series of preferred stock with respect to any directors elected (or to be elected) by the holders of that series, the total number of directors constituting the entire Board of Directors shall consist of not less than five nor more than fifteen members, with the precise number of directors to be determined from time to time by a vote of the Board of Directors.

By resolution of the Board of Directors, the present size of the Board has been established at nine.seven. The Bylaws include an advance notice procedure for stockholder approvals to be brought before an annual meeting of stockholders, including proposed nominations of persons for election to the Board of Directors. No nominations were received for the 20192020 Annual Meeting, and the nineseven nominees for the Board of Directors being recommended for election at the 20192020 Annual Meeting are being recommended by the Board of Directors, acting upon the recommendation of the Board's Nominating Committee. Each of the nineseven nominees, if elected, will hold office until the next annual meeting of stockholders and until his successor is elected and qualified. Each of the seven nominees is a current director of the Board. The Board has nominated Matthew Avril, Patrick A. Cozza, Thomas Herskovits, Brian R. Kahn, Andrew M. Laurence, Lawrence Miller, and G. William Minner, Jr., Bryant R. Riley and Kenneth M. Young for election as directors of the Company. Each nominee has consented to be named and to serve if elected. If any of the nominees becomes unavailable for election for any reason, the proxies will be voted for any substitute nominees.

DIRECTOR NOMINEES

The following table sets forth information regarding our director nominees and designees, as of the date of this Proxy Statement:

| Name | Age | Position(s) | ||

| Matthew Avril | ||||

| Patrick A. Cozza | Director | |||

| Thomas Herskovits | Director | |||

| Brian R. Kahn | President, CEO and Director | |||

| Andrew M. Laurence | Executive Vice President and Director | |||

| Lawrence Miller | Director | |||

| G. William Minner, Jr. | 66 | |||

| Director | ||||

QUALIFICATIONS AND EXPERIENCE OF DIRECTOR NOMINEES

Matthew Avril. Mr. Avril, age 58,59, has served as a director of the Company since September 2018 and is a self-employed consultant. He was appointed as Chairman of the Board of Directors in March 2020. He is currently a member of the strategic advisory board of Vintage.Vintage Capital Management, LLC (“Vintage”). Since January 2018, he has been a director of Babcock & Wilcox.Wilcox Enterprises, Inc. (“Babcock & Wilcox”). From November 2016 to March 2017, he served as Chief Executive Officer of Diamond Resorts International, Inc., a company in the hospitality and vacation ownership industries. From July 2014 until June 2016, Mr. Avril was a director of Aaron’s, Inc. From March 2011 to April 2016, Mr. Avril was a director of API Technologies. From February 2015 to March 2016, he was consultant to and Chief Executive Officer-elect for Vistana Signature Experiences, Inc. (“Vistana”), a vacation ownership business. Previously, he served as President, Hotel Group, for Starwood Hotels & Resorts Worldwide, Inc. (“Starwood”), an international hotel and leisure company, from August 2008 to July 2012. From 2002 to 2008, he served in a number of executive leadership positions with Starwood, and from 1989 to 1998, held various senior leadership positions with Vistana. Mr. Avril’s management background provides substantial additional expertise to the Board. Mr. Avril is a Certified Public Accountant (inactive status). Mr. Avril received a B.S.(Accounting) from the University of Miami.

Patrick A. Cozza. Mr. Cozza, age 63,64, has served as a director of the Company since May 2018 and is managing partner of Cozza Enterprises, LLC, a firm that provides strategic consultation and executive coaching services, a position he has held since January 2014. Mr. Cozza also serves as an Executive in Residence and Lecturer, Wealth Management, at the Silberman College of Business, Fairleigh Dickinson University. Mr. Cozza was formerly Chairman and Chief Executive Officer of HSBC Insurance North America, which operated four insurance companies with operations in the United States, Canada, Mexico, India and the United Kingdom, from January 2006 to December 2014. Concurrently, Mr. Cozza served as Senior Executive Vice President, Retail Banking and Wealth Management - North America for HSBC from January 2011 to December 2014, and previously served as Group Executive, Taxpayer Financial Services and North America and Mexico Insurance for HSBC from January 2002 to December 2006. HSBC Holdings plc is one of the world’s largest banking and financial services organizations. Mr. Cozza was also Chief Executive Officer of Taxpayer Financial Services from 2000 to 2002 and held a variety of senior leadership positions, including Chief Financial Officer, Chief Operating Officer and President of the Beneficial Insurance Group subsidiaries of Beneficial Corporation from 1985 to 1998. Mr. Cozza serves on the Boards of Directors of Scottish Re Life Insurance Company, the National Association of Corporate Directors, New Jersey Chapter,where he holds the designation of Board Leadership Fellow, Junior Achievement of New Jersey and the Silberman College of Business at Fairleigh Dickinson University. Mr. Cozza provides substantial management, leadership and strategic business experience and expertise to the Board of Directors. Mr. Cozza received a B.S. from Seton Hall University and an M.B.A. from Fairleigh Dickinson University.

Thomas Herskovits. Mr. Herskovits, age 72,73, served as a director of the Company from October 2015 until November 2017 and was reappointed to serve as a director in March 2018. Since 2014, Mr. Herskovits has been managing director of Feldman Advisors, a middle market investment banking firm based in Chicago, and since 1996, he has managed private investments through Herskovits Enterprises. From 2013 through February 2014, he was CEO of WinView, Inc., a technology company. He served on the Board of Directors of that privately-held company from 2012 to 2015. He previously served as non-operating Chairman of the Board of Directors of Natural Golf Corporation, a golf equipment and instruction company, as President & CEO of Specialty Foods, and as President of Kraft Dairy and Frozen Products. Mr. Herskovits was President of the Breakfast Foods Division of General Foods and spent the first nine years of his career in brand management at The Procter & Gamble Company. Mr. Herskovits’ management, finance and consumer products backgrounds provide substantial additional expertise to the Board. Mr. Herskovits received a B.S. in Architecture and Finance and an M.B.A. in Finance and Marketing from Syracuse University.

Brian R. Kahn. Mr. Kahn, age 45,46, has served as a director of the Company since September 2018 and as the Company's President and Chief Executive Officer since October 2019. Mr. Kahn founded and has served as the investment manager of Vintage and its predecessor, Kahn Capital Management, LLC, since 1998. Vintage is a value-oriented, operations-focused, private and public equity investor specializing in the consumer, aerospace and defense, and manufacturing sectors. Since 2012, Mr. Kahn has served as Chairman of the Board of Directors of Buddy’s, an operator and franchisor of rent-to-own stores under the banners of Buddy’s Home Furnishings, Flexi Compras Corp., and Good-to-Go Wheels and Tires. Since January 2018, Mr. Kahn has been a director of Babcock & Wilcox, Enterprises, Inc. (“Babcock & Wilcox”), a global leader in energy and environmental technologies and services for the power and industrial markets. Previously, Mr. Kahn was the Chairman of the board of directors of API Technologies Corporation from 2011 until 2016 and White Electronic Designs Corporation from 2009 until 2010. Mr. Kahn has also served as a director of Aaron’s, Inc., a leader in the sales and lease ownership and specialty retailing of residential furniture, consumer electronics, home appliances and accessories from 2014 until 2015 and Integral Systems, Inc., a provider of products, systems and services for satellite command and control, telemetry and digital signal processing, data communications, enterprise network management and communications information assurance, from 2011 to 2012. Mr. Kahn brings to the Board extensive management and consumer finance expertise, as well as public company experience. Mr. Kahn received a B.A. from Harvard University.

Andrew M. Laurence. Mr. Laurence, age 44,45, has served as a director of the Company since September 2018 and its Executive Vice President since October 2019. Mr. Laurence is a partner of Vintage. Mr. Laurence joined Vintage in January 2010 and is responsible for all aspects of its transaction sourcing, due diligence and execution. Mr. Laurence served as Corporate Secretary of API Technologies from January 2011 until February 2016; he also served as Vice President of Finance and Chief Accounting Officer from January 2011 to June 2011. Since January 2015, Mr. Laurence has been a director and member of the audit committee of IEC Electronics Corp., a provider of electronic manufacturing services to advanced technology companies that produce life-saving and mission critical products for the medical, industrial, aerospace and defense sectors. Mr. Laurence also serves as a director of Energes Services, LLC, an oilfield services company located in Colorado and as Manager of East Coast Welding & Fabrication, LLC, a metals fabrication business based in Massachusetts. He is also a director of non-profits Good Sports, Inc. and Beth Israel Deaconess Hospital - Milton. Mr. Laurence’s finance experience provides substantial expertise to the Board. Mr. Laurence received a B.A. from Harvard University.

Lawrence Miller. Mr. Miller, age 70,71, has served as a director of the Company since May 2018 and is the founder and Vice Chairman of the Board of Directors of StoneMor Partners L.P., an owner and operator of cemeteries and funeral homes in the United States. From April 2004 to May 2017, Mr. Miller was Chairman of the Board, President and Chief Executive Officer of StoneMor Partners L.P. He also served as the Chief Executive Officer and President of Cornerstone Family Services from March 1999 through April 2004. Prior to joining Cornerstone, Mr. Miller was employed by The Loewen Group, Inc. (now known as the Alderwoods Group, Inc.), where he served in various management positions, including Executive Vice President of Operations from January 1997 until June 1998, and President of the Cemetery Division from March of 1995 until December 1996. Prior to joining The Loewen Group, Mr. Miller served as President and Chief Executive Officer of Osiris Holding Corporation, a private consolidator of cemeteries and funeral homes of which Mr. Miller was a one-third owner, from November 1987 until March 1995, when Osiris was sold to The Loewen Group. Mr. Miller served as President and Chief Operating Officer of Morlan International, Inc., one of the first publicly traded cemetery and funeral home consolidators from 1982 until 1987, when Morlan was sold to Service Corporation International. Mr. Miller brings to the Board of Directors extensive operating and managerial expertise, excellent leadership skills and significant experience in advancing growth strategies, including acquisitions and strategic alliances. Mr. Miller received a B.B.A and an M.B.A. in Finance from Temple University.

G. William Minner, Jr. Mr. Minner, age 66, has served as a director of the Company since February 2018. Since 1996, Mr. Minner has served as a contract Chief Financial Officer and consultant with responsibilities for finance and administration to over 25 companies. From June 1991 to December 1995, Mr. Minner served as Chairman, President and Chief Executive Officer of Suburban Federal Savings Bank in Collingdale, Pennsylvania. From December 1988 to May 1991, Mr. Minner served in various positions with Atlantic Financial Savings, F.A., including Senior Vice President - Credit and First Vice President - Loan Workout. Previously, Mr. Minner served as Audit Manager and Controller for the mortgage subsidiary of Magnet Bank, FSB from July 1984 to December 1988. Mr. Minner is a Certified Public Accountant. Mr. Minner has substantial experience in the financial services industry, including banking, lending, risk management, treasury management, financial analysis, SEC reporting, taxation, accounting and commercial real estate development. Mr. Minner qualifies as an audit committee financial expert under SEC rules. Mr. Minner received an M.B.A. and M.S. in Accounting from Marshall University.

COMMITTEES OF THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our Board of Directors currently has four standing committees: the Audit Committee, the Compensation Committee, the Nominating Committee and the Risk Committee. The responsibilities of each committee are described below. Members serve on these committees until their resignation or until otherwise determined by our Board of Directors. The chart below reflects the current composition of each of the standing committees.

| Name of Director | Audit Committee | Compensation Committee | Nominating Committee | Risk Committee | ||||

| Matthew Avril | X | X | ||||||

| Patrick A. Cozza | X | X(1) | X | |||||

| Thomas Herskovits | X(1) | X | ||||||

| Brian R. Kahn | ||||||||

| Andrew M. Laurence | X | |||||||

| Lawrence Miller | X | X(1) | ||||||

| G. William Minner, Jr. | X(1) | |||||||

| X | ||||||||

(1) Chairperson of Committee

Audit Committee

Our Audit Committee, which met thirteenten times during Fiscal 2019,the Transition Period, provides oversight of our accounting and financial reporting process, the audit of our financial statements and our internal control function. Among other matters, the Audit Committee assists the Board of Directors in oversight of the independent auditors' qualifications, independence and performance; is responsible for the engagement, retention and compensation of the independent auditors; reviews the scope of the annual audit; reviews and discusses with management and the independent auditors the results of the annual audit and the review of our quarterly consolidated financial statements, including the disclosures in our annual and quarterly reports filed with the Securities and Exchange Commission (the "SEC");SEC; reviews and oversees risk management related to financial matters; establishes procedures for receiving, retaining and investigating complaints received by us regarding accounting, internal accounting controls or audit matters; approves audit and permissible non-audit services provided by our independent auditor; and reviews and approves related party transactions under Item 404 of Regulation S-K. In addition, our Audit Committee oversees our internal audit function.

All members of our Audit Committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and NASDAQ. Our Board of Directors has determined that Mr. Minner has been designated the Company’s audit committee financial expert as defined under the applicable rules of the SEC and NASDAQ.The current members of the Audit Committee are listed above. The members of the Audit Committee during Fiscal 2019the Transition Period were Messrs. Cozza, Laurence, Miller, Minner and Herskovits and Mr. Ross Longfield.Bryant Riley who voluntarily stepped down from the Company's Board of Directors on March 31, 2020. All of the

current members of our Audit Committee are, and all of the members who served on the Audit Committee during Fiscal 2019the Transition Period were, independent as defined under the applicable rules and regulations of the SEC and NASDAQ. The Board has adopted a written Audit Committee Charter, which is available at the Company's website at www.libertytax.comwww.franchisegrp.com or upon written request to the Corporate Secretary, Liberty Tax,Assistant General Counsel, Franchise Group, Inc., 1716 Corporate Landing Parkway, Virginia Beach, Virginia 23454.

Compensation Committee

Our Compensation Committee, which met eightnine times during Fiscal 2019,the Transition Period, adopts and administers the compensation policies, plans and benefit programs for our executive officers and all other members of our executive team. In addition, among other things, our Compensation Committee annually evaluates, in consultation with the Board of Directors, the performance of our Chief Executive Officer, reviews and approves corporate goals and objectives relevant to compensation of our Chief Executive Officer and other executives and evaluates the performance of these executives in light of those goals and objectives. Our Compensation Committee also adopts and administers our equity compensation plans.

The current members of the Compensation Committee are listed above. The members of the Compensation Committee during Fiscal 2019the Transition Period were Messrs. Avril, Cozza, Herskovits, Longfield, Minner, and Young.Mr. Kenneth Young, who voluntarily stepped down from the Company’s Board of Directors on March 31, 2020. All of the current members of our Compensation Committee are, and all of the members who served on the Compensation Committee during Fiscal 2019the Transition Period were, independent under the applicable rules and regulations of the SEC and NASDAQ, and Section 162(m) of the Internal Revenue Code (the “Code”). The Board has adopted a written Compensation Committee Charter, which is available at the Company's website at www.libertytax.comwww.franchisegrp.com or upon written request to the Corporate Secretary, Liberty Tax,Assistant General Counsel, Franchise Group, Inc., 1716 Corporate Landing Parkway, Virginia Beach, Virginia 23454.

Nominating Committee

Our Nominating Committee, which met fourthree times during Fiscal 2019,the Transition Period, is responsible for, among other things, making recommendations regarding the composition of our Board of Directors, identification, evaluation and nomination of director candidates and the structure and composition of committees of our Board of Directors. The Nominating Committee is also responsible for considering candidates nominated by stockholders for election to the Board, evaluating the proposed candidates and making recommendations regarding the candidates to the Board. The Nominating Committee considers candidates for Board membership recommended by its members and other Board members, as well as by management and stockholders. While there are no formal procedures for stockholders to submit director candidate recommendations, the Nominating Committee will consider candidates recommended in writing by stockholders entitled to vote in the election of directors. Such written submissions should include the name, address, and telephone number of the recommended candidate, along with a brief statement of the candidate's qualifications to serve as a director. All such stockholder recommendations should be submitted to the attention of the Company’s SecretaryAssistant General Counsel at the Company’s principal office located at Corporate Secretary, Liberty Tax,Franchise Group, Inc., 1716 Corporate Landing Parkway, Virginia Beach, Virginia 23454 and must be received in a reasonable time prior to the next annual election of directors to be considered by the Nominating Committee. Any director candidate recommended by a stockholder will be reviewed and considered by the Nominating Committee in the same manner as all other director candidates based on the qualifications described in this section. In addition, our Nominating Committee approves our Committee charters, oversees compliance with our code of business conduct and ethics, reviews actual and potential conflicts of interest of our directors and officers other than related party transactions reviewed by the Audit Committee and oversees the Board self-evaluation process.

In evaluating candidates for election to the Board, the Nominating Committee takes into account the qualifications of the individual candidate as well as the composition of the Board as a whole. In nominating candidates, the Committee takes into consideration the qualifications for directors included in the Board Charter and Corporate Governance Guidelines and such other factors as it deems appropriate. These factors may include judgment, skill, diversity, experience with businesses and other organizations of comparable size, the interplay of the candidate’s experience with the experience of other Board members, and the extent to which the candidate would be a desirable addition to the Board and any committees of the Board. Pursuant to its Charter, the Nominating Committee has the authority to retain consultants or search firms to identify director candidates.

The current members of the Nominating Committee are listed above. The members of the Nominating Committee during Fiscal 2019the Transition Period were Messrs. Herskovits, Kahn, Longfield, Miller, Minner and Young. All of the current members of our Nominating Committee are, and all members who served on the Nominating Committee during Fiscal 2019the Transition Period were, independent under the rules and regulations of NASDAQ. The Board has adopted a written Nominating Committee Charter, which is available at the Company’s website at www.libertytax.comwww.franchisegrp.com or upon written request to the Corporate Secretary, Liberty Tax,Assistant General Counsel, Franchise Group, Inc., 1716 Corporate Landing Parkway, Virginia Beach, Virginia 23454.

Risk Committee

Our Risk Committee, which met fivethree times during Fiscal 2019,the Transition Period, is responsible for, among other things, risk governance structure, risk management, and review of operational risk assessment guidelines and policies. All of the current members of our Risk Committee are independent under the rules and regulations of NASDAQ. In addition, our Risk Committee oversees the performance of the internal compliance department, evaluates and reports on the adequacy of our system of internal controls and processes governing all aspects of compliance operations. Our Risk Committee is also responsible for assisting the Board of Directors in its oversight and review of information regarding our risk management approach.

Meeting Attendance

During Fiscal 2019,the Transition Period, our Board of Directors held eleventwenty-six meetings, either in person or by telephone. Each director attended at least 75% of the aggregate of (1) the total number of meetings of the Board of Directors held while he was a director, and (2) the total number of meetings held by all committees on which he served during the periods that he served on the committee.

Delinquent Section 16(a) Beneficial Ownership Reporting ComplianceReports

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), requires our officers and directors, and beneficial owners of more than 10% of our Common Stock, to file with the SEC reports detailing their ownership of our Common Stock and changes in such ownership. Officers, directors and greater than 10% beneficial owners are required by SEC regulations to furnish us with copies of all Section 16(a) reports they file.

Director Attendance at Annual Meeting of Stockholders

All Board members attended the Company’s Annual Meeting of Stockholders held on December 13, 2018September 12, 2019 with the exception of Mr. Riley.Riley and Mr. Young. While the Company does not have a formal policy with respect to annual meeting attendance, directors are encouraged to attend all annual meetings of stockholders.

Communications with the Board

Stockholders and other interested parties wishing to communicate with the Board of Directors, the non-employee directors, or an individual Board member concerning the Company may do so by writing to the Board, to the non-employee directors, or to the particular Board member, and mailing the correspondence to the Corporate Secretary, Liberty Tax,Assistant General Counsel, Franchise Group, Inc., 1716 Corporate Landing Parkway, Virginia Beach, Virginia 23454. Please indicate on the envelope whether the communication is from a stockholder or other interested party. In addition, our Board members have made and may in the future make themselves available for consultation and direct communication with significant stockholders.

Code of Conduct

All directors, officers and employees of the Company must adhere to the ethical standards as set forth in the Liberty Tax, Inc.Company's Code of Conduct (the "Code of Conduct"), which was amended in July 2018 to address policies and procedures including, but not limited to, conflicts of interests and related party transactions. The fundamental principles outlined in the Code of Conduct serve as a guide for matters, including but not limited to, adhering to ethical standards in day to day activities, engaging in fair dealings and best business practices, complying with state, federal and foreign laws, identifying conflicts of interest, ensuring financial integrity and reporting violations of the Code of Conduct. There are many resources in which potential violations of the Code of Conduct may be reported as well as related concerns or to seek guidance on ethical matters through in-person, email and telephone communications. The Company has established a Code of Conduct Hotline at 800-216-1288 and reports of possible violation can also be made to the Human Resources Director,Officer, the Compliance Department on the Compliance Hotline at 877-472-2110 or by email at www.lighthouse-services.com/libtax.

The Code of Conduct is available upon written request directed to the Corporate SecretaryAssistant General Counsel in writing at 1716 Corporate Landing Parkway, Virginia Beach, Virginia 23454, Attention: Corporate Secretary,Assistant General Counsel, or by email at kathleen.curry@libtax.com.

NON-EMPLOYEE DIRECTOR COMPENSATION

Non-employee director compensation is reviewed and approved by the Board based on the recommendations of the Compensation Committee of the Board. The Compensation Committee periodically reviews non-employee director compensation in an effort to determine if the Company pays competitive compensation to attract and retain highly-qualified directors. In Fiscal 2019,the Transition Period, non-employee directors received the option of an annual retainer of $45,000 or an equal amount of compensation in the form of restricted stock. In addition, for those directors who served on the Audit Committee, Compensation Committee, Nominating Committee and Risk Committee, members received annual retainers of $10,000, $7,500, $5,000 and $5,000, respectively, and the chairpersons received annual retainers of $20,000, $10,000, $7,500 and $7,500, respectively. During the Transition Period, two independent Special Committees were formed in connection with the Company’s acquisition of Buddy’s Home Furnishings in July 2019 and in connection with the Company’s acquisition of 21 Buddy’s Home Furnishings stores in September 2019, each of which were composed of Messrs. Cozza (Chairman), Herskovits, Miller and Minner. For each Special Committee on which he served, each director received $10,000 and the chairperson received a retainer of $15,000. Our committee members are also entitled to receive this cash compensation in the form of restricted stock, if they so elect. For Fiscal 2019,the Transition Period, we also granted each of our non-employee directors stock-based compensation in the form of stock options and restricted stock units (“RSUs”) in a total combined approximate annual value of $65,000. The Chairman of the Board of Directors receives

compensation in an amount 50% greater relative to the other non-employee directors in an equal mix of cash and equity. Non-employee director

For Fiscal 2020, non-employee directors will receive an annual retainer of $55,000 or an equal amount of compensation is unchanged forin the fiscal year endingform of restricted stock. In addition, those directors who serve as Chairperson of the Audit Committee, Compensation Committee, Nominating Committee and Risk Committee will receive annual retainers of $20,000, $15,000, $10,000 and $10,000, respectively. Our committee members are also entitled to receive this cash compensation in the form of restricted stock, if they so elect. For Fiscal 2020, we also granted each of our non-employee directors stock-based compensation in the form of restricted stock units (“RSUs”) in a total combined approximate annual value of $120,000. The Chairman of the Board of Directors will receive an additional equity retainer equivalent to an approximate annual value of $100,000. In April, 30, 2020.the Company announced that the Board of Directors agreed to a temporary reduction of its cash compensation by 50% in response to the impact of the COVID-19 pandemic.

The table below sets forth all compensation paid to our non-employee directors for Fiscal 2019.Transition Period. Information regarding Ms. Ossenfort’sMr. Kahn and Mr. Laurence's compensation for Fiscal 2019Transition Period is included under “Executive Compensation.”

| Name | Fees Earned or Paid in Cash | Stock Awards (1) (2) | Option Awards (3) (4) | All Other Compensation | Total | |||||

| Matthew Avril (5) | $40,652 | $21,666 | $43,334 | $— | $105,652 | |||||

| Patrick A. Cozza (6) | 60,054 | 21,666 | 43,334 | — | 125,054 | |||||

| Gordon D'Angelo (7) | 12,989 | — | — | — | 12,989 | |||||

| Thomas Herskovits (8) | 70,054 | 21,666 | 43,334 | — | 135,054 | |||||

| John T. Hewitt (9) | 11,250 | — | — | — | 11,250 | |||||

| Brian R. Kahn (10) | 42,228 | 21,666 | 43,334 | — | 107,228 | |||||

| Andrew M. Laurence (11) | 51,033 | 32,499 | 64,999 | — | 148,531 | |||||

| Ross N. Longfield (12) | 5,897 | — | — | — | 5,897 | |||||

| Ellen M. McDowell (13) | 12,690 | — | — | — | 12,690 | |||||

| Lawrence Miller (14) | 55,326 | 21,666 | 43,334 | — | 120,326 | |||||

| G. William Minner, Jr. (15) | 74,348 | 21,666 | 43,334 | — | 139,348 | |||||

| Bryant R. Riley (16) | 45,380 | 21,666 | 43,334 | — | 110,380 | |||||

| John Seal (17) | 12,120 | — | — | — | 12,120 | |||||

| Kenneth M. Young (18) | 40,652 | 21,666 | 43,334 | — | 105,652 | |||||

| Name | Fees Earned or Paid in Cash | Stock Awards (1) (2) | Option Awards (3) (4) | All Other Compensation | Total | |||||||||||||||

| Matthew Avril | $ | 38,139 | $ | 21,665 | $ | 43,334 | $ | — | $ | 103,138 | ||||||||||

| Patrick A. Cozza | 72,745 | 21,665 | 43,334 | — | 137,744 | |||||||||||||||

| Thomas Herskovits | 63,899 | 21,665 | 43,334 | — | 128,898 | |||||||||||||||

| Lawrence Miller | 58,139 | 21,665 | 43,334 | — | 123,138 | |||||||||||||||

| G. William Minner, Jr. | 67,188 | 21,665 | 43,334 | — | 132,187 | |||||||||||||||

| Bryant R. Riley (5) | 41,440 | 21,665 | 43,334 | — | 106,439 | |||||||||||||||

| Kenneth M. Young (5) | 37,323 | 21,665 | 43,334 | — | 102,322 | |||||||||||||||

| (1) | Amounts in this column reflect the grant date fair value of the restricted stock and RSUs granted to each non-employee director under the Company's 2011 Equity and Cash Incentive Plan, calculated in accordance with FASB Accounting Standards Codification Topic 718 ("ASC Topic 718"), based on the fair market value, as determined by the Board of Directors, of the Company's stock on the effective date of grant. Assumptions used in the calculation of these amounts for |

| (2) | The value reported in the “Stock Awards” column represents RSUs granted to directors which generally vest and become subject to settlement 12 months after the date of grant. Each RSU represents the right to receive upon settlement of one share of the Company’s Common Stock. The aggregate amount of RSUs outstanding as of |

| (3) | Amounts in this column reflect the grant date fair value of the options granted to each director, under the Company's 2019 Omnibus Incentive Plan or 2011 Equity and Cash Incentive Plan calculated in accordance with ASC Topic 718, based on the fair market value, as determined by the Board of Directors of the Company's stock on the date of grant. |

| (4) | The aggregate number of option awards outstanding as of |

| (5) |

DIRECTOR INDEPENDENCE AND BOARD STRUCTURE

Our Board of Directors has undertaken a review of its composition, the composition of its committees and the independence of each director. Based on the review of each director's background, employment and affiliations, including family relationships, the Board of Directors has determined that, except for Mr. Kahn and Mr. Laurence, all of our current directors are “independent” under the applicable rules and regulations of the SEC and NASDAQ. Mr. Longfield, a former director that served during Fiscal 2019 was also deemed independent. In making this determination, our Board of Directors considered the current and prior relationships that each non-employee director has with the Company and all other facts and circumstances our Board of Directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock.

The Risk Committee was established to have oversight responsibility of the Company’s risk governance structure, risk management and to monitor the Company's operational risks. However, the Board of Directors expects the Company’s management to take primary responsibility for identifying material risks the Company faces and communicating them to the Risk Committee and to the Board, developing and implementing appropriate risk management strategies responsive to those risks with oversight from the Risk Committee, and integrating

risk management into the Company's decision-making processes. The Board of Directors regularly reviews information regarding the Company’s credit, liquidity, regulatory and operational risks as well as strategies for addressing and managing these risks. Certain other committees of the Board, such as the Audit and Compensation Committees, manage risks within their area of responsibility. In particular, the Audit Committee monitors financial, credit and liquidity risk issues, and the Compensation Committee monitors the Company's compensation programs so that those programs do not encourage excessive risk-taking by Company employees.

The Board of Directors unanimously recommends that you vote "FOR" the election to the Board of Directors each of the nineseven nominees identified above as "Director Nominees."

EXECUTIVE OFFICERS

The following table sets forth certain information regarding our current executive officers:

| Name | Age | Position(s) | ||

| Chief Financial Officer | ||||

| Executive Vice President and Chief | ||||

Andrew F. Kaminsky. Mr. Kaminsky has served as the Company's Executive Vice President and Chief OperatingAdministrative Officer since October 2, 2019. Prior to joining the Company, Mr. Kaminsky held various executive and operating positions with Viavi Solutions Inc., Cobham plc and Aeroflex Holding Corp. From April 2018 through June 2019, Mr. Kaminsky was an Executive Consultant in Strategic Initiatives to the CEO of Viavi Solutions Inc., focusing on mergers and acquisitions, their subsequent integration and driving operational efficiencies across the company. From September 2014 through April 2018, Mr. Kaminsky held various roles with Cobham plc, most recently as the Senior Vice President of Strategic Initiatives. From March 2010 through its sale to Cobham plc in September 2014, Mr. Kaminsky was a Senior Vice President and Head of Corporate Development, Investor Relations and Human Resources for Aeroflex Holding Corp. Prior to his corporate roles, Mr. Kaminsky spent over 15 years as an investment banker, including as a Managing Director at Oppenheimer & Co. Inc. and CIBC. In 2001, Mr. Kaminsky co-founded and presently serves as the Chairman and Executive Director of the Company since February 2018.Greg Richards, Larry Polatsch and Scott Weingard Memorial Fund, a 9/11 not-for-profit charity. Mr. Kaminsky holds a Bachelor’s degree from the University of Michigan and a M.B.A. in Finance and Management from the Stern School of Business at New York has been involved with the Company since 2003 when he started working with the Central Florida ADs. He joined the Company as a franchisee in October of 2003. Currently he owns multiple franchise locations in the Tampa, Florida area. Over the last ten years, Mr. York has been an AD in Tampa, Polk County and Brevard County in Florida and in Birmingham, Alabama (the latter of which was sold in 2016). Over the past five years, Mr. York has periodically worked as a consultant or an employee of the Company, serving in various operations roles.University.

COMPENSATION DISCUSSION AND ANALYSIS

Our compensation discussion and analysis for Fiscal 2019the Transition Period (the “CD&A”) discusses the compensation for our “named executive officers” set forth in detail in the Fiscal 2019Transition Period Summary Compensation Table and the other tables and accompanying footnotes that follow this section. This section explains our executive compensation philosophy, objectives and design, our compensation-setting process, our executive compensation program components and the decisions made in Fiscal 2019the Transition Period for our named executive officers.

Our named executive officers during Fiscal 2019the Transition Period consisted of the following individuals:

| Name | Position(s) | |

| Executive Vice President | ||

| Andrew F. Kaminsky | Executive Vice President and Chief | |

| (1) | Ms. Ossenfort left the Company in June 2019. |

| (2) | Mr. |

Impact of the COVID-19 Pandemic on Compensation

As a result of the business and market volatility, the uncertainty caused by the global outbreak of the COVID-19 pandemic, the Company has temporarily reduced the base salary for Mr. Kahn by 50% and the base salary for the Company's other executive officers, including its Chief Financial Officer, by 30% - 40%.

The Company has also announced several other additional cost-saving measures to mitigate the operating and financial impact of the COVID-19 pandemic, including approaching landlords to seek rent deferrals and abatements, furloughing employees, suspending all non-essential capital expenditures, dramatically reducing non-committed or contractual marketing activities and delaying non-essential projects and programs.

The below CD&A provides an overview of our business performance for the Transition Period, highlights the key components and structure of our executive compensation program, discusses the principles underlying our compensation policies and procedures and addresses other matters we believe explain and demonstrate our performance-based compensation philosophy. Because it describes our executive compensation program for the Transition Period, in most cases, this CD&A does not address the impact of COVID-19 pandemic on the global economy, our business and financial results or our executive compensation for Fiscal 2020.

Compensation Overview and Objectives

We strive to establish compensation practices that attract, retain and reward our senior management, and strengthen the mutuality of interests between our senior management and our stockholders. We believe that the most effective executive compensation program is one that is conservative, but competitive, and that aligns the compensation of our senior management with the creation of stockholder value. Under the oversight of the Compensation Committee, we have developed and implemented a pay-for-performance executive compensation program that rewards senior management for the achievement of certain financial performance objectives. We achieve the philosophies of pay-for-performance and alignment of senior management compensation with stockholder value creation primarily by providing a substantial portion of each executive's total annual compensation through annual performance bonuses and grants of long-term equity compensation. For Fiscal 2019,the Transition Period, the Compensation Committee tied the level of potential bonus payments for each of the named executive officers solely to Company-wide financial performance objectives.

Determination of Compensation

Our Compensation Committee is responsible for determining our compensation and benefit plans generally and has established and reviewed all compensatory plans and arrangements with respect to our named executive officers. The Compensation Committee meets not less than four times annually to specifically review and determine adjustments, if any, to all elements of compensation, including base salary, annual bonus compensation and long-term equity awards. The Compensation Committee annually evaluates the achievement of performance goals for the prior fiscal year and sets new performance goals for the current fiscal year. The Compensation Committee also meets additionally as needed to discuss compensation-related matters as they arise during the year. The Compensation Committee is also responsible for reviewing and approving total compensation packages for new executive officers, as well as severance payments for departing executive officers.

In addition, with respect to the compensation of our named executive officers, other than our Chief Executive Officer, the Compensation Committee seeks the input and recommendation of our Chief Executive Officer. Our Chief Executive Officer reviews each other named executive officer’s overall performance and contribution to the Company at the end of each fiscal year and makes recommendations regarding their compensation to the Compensation Committee. Our Chief Executive Officer’s compensation is determined solely by the Compensation Committee. Our current interim Chief Executive Officer, does not,former Chief Executive Officer and our former Interim Chief Executive Officer did not participate in any formal discussion with the Compensation Committee regarding his or her compensation.

The Compensation Committee does not generally rely on formulaic guidelines for determining the mix or levels of cash and equity-based compensation, but rather maintains a flexible compensation program that allows it to adapt components and levels of compensation to motivate and reward individual executives within the context of our desire to attain certain strategic and financial goals. Subjective factors considered in compensation determinations include an executive’s skills and capabilities, contributions as a member of the executive management team, contributions to our overall performance and the sufficiency of total compensation potential and structure to ensure the retention of an executive when considering the compensation potential that may be available elsewhere.

Independent Compensation Consultant

In April 2018,September 2019, the Compensation Committee engaged Pearl Meyer & Partners LLC (“Pearl Meyer”), an independent compensation consultant, to provide a complete market analysis and assessment of the competitiveness of the Company’s executive compensation program. As part of its engagement, Pearl Meyer assisted the Compensation Committee in reviewing themarket data regarding salary, annual cash incentive award targets, and equity-based and other long-term incentive compensation paid by a peer group of companiesawards to assess the competitiveness of the compensation of our executives. In connection with the analysis of equity-based and other long-term incentive compensation for our executives, Pearl Meyer provided market data for performance-based restricted stock unit plans using relative total shareholder return as the performance measure. The peer group selected by the Compensation Committee, in consultation with Pearl Meyer, for purposes of evaluating compensation of the executivesa performance-based restricted stock unit plan, consisted of sixteenthirty-one publicly-traded companies chosen because of their comparable revenues and/or market capitalization, status and size as franchisors, and/or their participation in our industry or similar industries. The peer group consisted of the following companies:

In connection with the April 2018September 2019 compensation study by Pearl Meyer, the Compensation Committee approved, and the Company entered into employment agreements with Messrs. PiperKahn, Laurence and York and Ms. Ossenfort.Kaminsky. Those agreements, along with the agreements for the other named executive officers isare further described in “Individual Compensation Arrangements with Named Executive Officers.”

The Compensation Committee values the input of our stockholders regarding the design and effectiveness of our executive compensation program. At the 20182019 annual meeting of stockholders, the Company asked its stockholders to vote to approve, on an advisory basis, the Company’s executive compensation. Although the advisory stockholder vote on executive compensation was non-binding, the Compensation Committee has considered, and will continue to consider, the outcome of this vote each year when making compensation decisions for our Chief Executive Officer and other executive officers. Approximately 99%99.9% of the stockholders who voted on the “say-on-pay” proposal at the 20182019 annual meeting of stockholders approved the compensation of our named executive officers, while approximately 1%0.1% voted against the proposal. In light of such strong support, the Compensation Committee determined that no significant additional changes were needed to the executive compensation program for Fiscal 2019.2020. Nonetheless, because market practice and our business needs continue to evolve, the Compensation Committee continually evaluates our compensation program and makes changes when warranted.

Components of Compensation for Fiscal 2019the Transition Period

For Fiscal 2019,the Transition Period, the compensation provided to our named executive officers consisted of base salary, annual bonus, long-term equity-based compensation, performance-based equity incentives, retirement benefits and other benefits, each of which is described in more detail below. We believe that the mix of cash- and equity-based compensation, as well as the relationship of fixed to performance-based compensation, is properly balanced and provides us with an effective means to attract, motivate and retain our named executive officers, as well as reward them for creation of stockholder value.

1The thirty-one peer group companies are: 1-800-FLOWERS.COM, Inc., Aaron's, Inc., At Home Group Inc., Best Buy Co., Inc., Big Lots, Inc., Carriage Services, Inc., CBIZ, Inc., Conn's, Inc., Denny's Corporation, Dine Brands Global, Inc., Domino's Pizza, Inc., Dunkin' Brands Group, Inc., EZCORP, Inc., FirstCash, Inc., GNC Holdings, Inc., H&R Block, Inc., Jack in the Box Inc., MTY Food Group Inc., Ollie's Bargain Outlet Holdings, Inc., OneMain Holdings, Inc., Papa John's International, Inc., RE/MAX Holdings, Inc., Realogy Holdings Corp., Regional Management Corp., Regis Corporation, Rent-A-Center, Inc., Resources Connection, Inc., Ruth's Hospitality Group, Inc., Strategic Education, Inc., The Wendy's Company, and World Acceptance Corporation.

Base Salary

The base salary payable to each named executive officer is intended to provide a fixed component of compensation reflecting the executive's skill set, experience, role and responsibilities. Base salary amounts are established at the time of each named executive officer's initial employment with the Company, but are subject to upward adjustment by the Compensation Committee after its consideration of, among other factors, the scope of the executive's responsibilities, individual performance for the prior year, the mix of fixed compensation to overall compensation and consistency with what the Compensation Committee considers to be the market standard for compensation paid to similarly-situated executives at other companies.

Annual Bonuses

The Company has an annual performance bonus plan (a short-term cash incentive bonus plan with annual financial, and in some cases, individual performance goals), through which we provide for cash bonus awards to certain of our senior employees, including all of our named executive officers. Annual bonuses which are generally paid during June for the prior fiscal year’s performance, are intended to compensate executives for achieving annual company-wide financial goals and, in some instances, individual performance goals. Under our bonus plan, our Compensation Committee establishes a target bonus amount (expressed as a percentage of base salary) for each of our executives that would become payable upon the achievement of our corporate performance metrics, subject to the Compensation Committee discretion. Actual bonuses were to be based upon the achievement of the applicable performance objectives. No bonuses were to be earned under the bonus plan unless income before income taxes exceeded the prior year’s income before income taxes. Our Compensation Committee also had the discretion to award an additional bonus to the extent that the Company exceeded the target performance metrics.

| Name | Adjusted EBITDA | Franchise Performance | Cost Reductions | Corporate Governance | Total Target Bonus as Percentage of Base Salary | |||||

| Nicole Ossenfort | 60% | 15% | 10% | 15% | 80% | |||||

| Michael S. Piper | 60% | 15% | 10% | 15% | 80% | |||||

| Shaun York | 60% | 15% | 10% | 15% | 80% | |||||

| Nicholas E. Bates (1) | —% | —% | —% | —% | —% | |||||

Long-term equity compensation

On August 26, 2011,November 10, 2019, in consideration of the benefits of long-term equity incentive awards and upon the recommendation of our Compensation Committee, our Board of Directors adopted 2019 Omnibus Incentive Plan (also referred to in this Proxy Statement as the “2019 Omnibus Plan” or the “2019 Plan”). The 2019 Plan, which reserved 5,000,000 shares of Common Stock for issuance, was subsequently approved by our stockholders by written consent on December 4, 2019. Simultaneously with stockholder approval of the 2019 Plan, the Company’s prior equity incentive compensation plan, the JTH Holding, Inc. 2011 Equity and Cash Incentive Plan (referred to as the “2011 Equity and Cash Incentive Plan” or the(the “2011 Plan”). The, was terminated. No new awards will be granted under the 2011 Plan, was subsequently approved by our stockholders on August 30, 2011. The Plan provides us with the ability to utilize different types of equity incentivealthough awards (compared to only the stock options availablepreviously granted under the 1998 Plan) as a part2011 Plan and still outstanding will continue to be subject to all terms and conditions of the 2011 Plan.